Saumitra Jha On Using Finance To Build Social Cohesion

Saumitra Jha is Associate Professor of Political Economy at Stanford Graduate School of Business, with courtesy appointments in Economics and Political Science at Stanford University. He is a Senior Fellow at the Freeman Spogli Institute for International Studies and the Stanford Institute for Economic Policy Research, a Faculty Fellow at the Center for Advanced Study in the Behavioral Sciences, and convenor of the Stanford Conflict and Polarization Lab.

By Aiden Singh, February 10, 2026

Itay Goldstein On Stock Trading Frenzies, Financial Contagion, & Whether Mutual Fund Flows Can Predict Business Cycles

Itay Goldstein is a Professor of Finance at the Wharton School of the University of Pennsylvania and Chair of the Finance Department. He is also Director of the Wharton Initiative on Financial Policy and Regulation.

By Aiden Singh, January 7, 2025

Hannah Farber On How Insurance Shaped The Development Of The Early United States

Hannah Farber is Associate Professor of History at Columbia University. She is a Member of the State of the Union Working Group.

By Aiden Singh, November 24, 2025

Robert Seamans On The Economic Effects Of AI, Serving As An Economic Advisor to President Obama, & Universal Basic Income

Robert Seamans is Professor of Management at New York University’s (NYU) Stern School of Business & former Senior Economist for Technology and Innovation on President Obama's Council of Economic Advisers (2015 - 2016). He is a Member of the State of the Union Working Group.

By Aiden Singh, November 11, 2025

Labour’s Brexit Stance Is As Untenable As Their Tax Pledge

By Simon Wren-Lewis, November 11, 2025

Simon Wren-Lewis is Emeritus Professor of Economics and Fellow of Merton College, University of Oxford. He Was One of the Seven Members of the UK Labour Party’s 2015-2016 Economic Advisory Committee.

James Nation On The Inner Workings Of The British State, Advising Prime Minister Rishi Sunak, & Running The 2024 Conservative Election Campaign

James Nation, OBE was Deputy Head of Policy Unit at 10 Downing Street For Prime Minister Rishi Sunak (2022 - 2024). Prior to this, he was a Special Advisor to Chancellor of the Exchequer Rishi Sunak (2020-2022). He led the team responsible for drawing up the Conservative Party Manifesto in the 2024 General Election campaign.

You can inquire about booking James Nation for a speaking engagement here.

By Aiden Singh, October 15, 2025

Aiden Singh is the Founder the Social Science Encyclopedia, the Expert Speakers Bureau, & the State of the Union Summit.

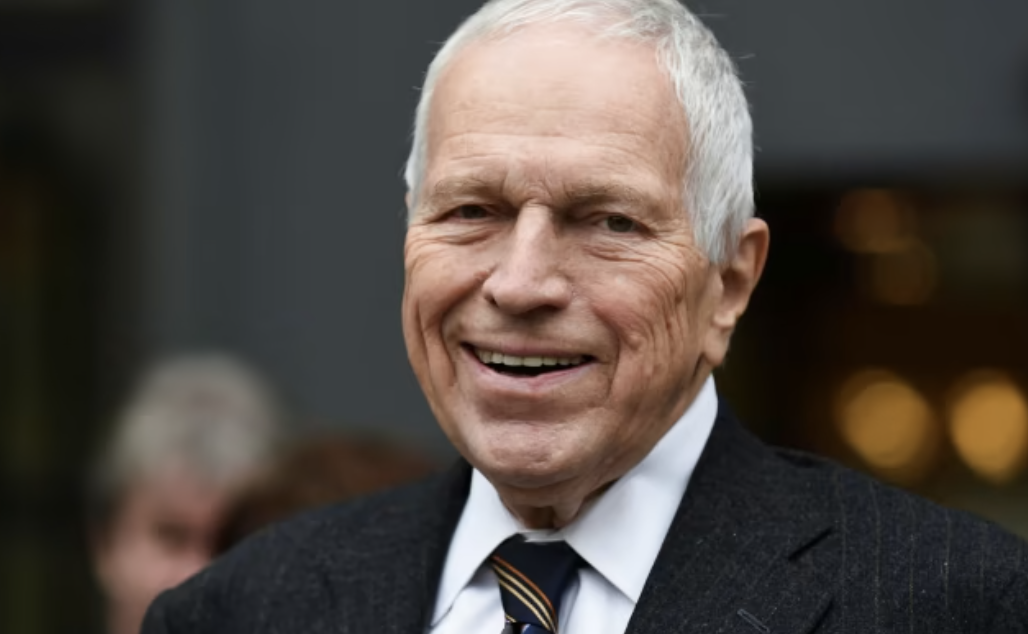

Edmund Phelps On Innovation, Prosperity, & The Good Life

Edmund Phelps Is The Winner Of The 2006 Nobel Memorial Prize In Economics.

He Is McVickar Professor Emeritus Of Political Economy At Columbia University.

By Aiden Singh, August 5, 2025

UK Growth, Productivity, and Investment

By Simon Wren-Lewis, August 5, 2025

Simon Wren-Lewis is Emeritus Professor of Economics and Fellow of Merton College, University of Oxford. He Was One of the Seven Members of the UK Labour Party’s 2015-2016 Economic Advisory Committee.

Kathryn Judge On Financial Fragility In The Shadow Banking System, Interbank Lending, & Overlooked Lenders Of Last Resort During The 2008 Financial Crisis

Kathryn Judge is Professor of Law at Columbia University School of Law.

By Aiden Singh, July 25, 2025

Igor Lukšić On Montenegrin Independence, Responding To The 2008 Global Financial Crisis, & Joining the E.U., Eurozone, And NATO

Igor Lukšić was the Prime Minister of Montenegro from 2010 - 2012, the Minister of Finance of Montenegro from 2004 - 2010, & the Minister of Foreign Affairs and European Integration of Montenegro from 2012 - 2016. He is a Member of the State of the Union Working Group.

He can be booked for a speaking or consulting engagement here.

By Aiden Singh, June 13, 2025

“I Was Receiving Frenzied Calls From All Sides. The Country Was On Fire.”

Igor Lukšić On Responding To The 2008 Global Financial Crisis As Finance Minister.

Igor Lukšić was the Prime Minister of Montenegro from 2010 - 2012, the Minister of Finance of Montenegro from 2004 - 2010, & the Minister of Foreign Affairs and European Integration of Montenegro from 2012 - 2016. He is a Member of the State of the Union Working Group.

He can be booked for a speaking or consulting engagement here.

By Aiden Singh, June 10, 2025

Raymond Ojserkis on The Causes and Consequences of Speculative Bubbles & Whether Central Banks Should Try To Burst Them

Raymond P. Ojserkis is a Lecturer at Rutgers University Where He Teaches Courses On Boom/Bust Cycles & American Economic History. He is a Senior Advisor to the Expert Insights Group (EIG) & a Member of the State of the Union Working Group..

By Aiden Singh, June 4, 2025

Leveraging Government-Owned Land as a Catalyst for Private Investment

By Dag Detter, May 5, 2025

Dag Detter is a Financial Advisor to Governments Worldwide, Former President of the Swedish National Wealth Fund, & a Member of the State of the Union Working Group.

He will be appearing on the Leveraging Government-Owned Land as a Catalyst for Private Investment panel at the 2025 ULI Spring Meeting.

He Can Be Booked For A Speaking or Consulting Engagement Here.

Alvin Roth On Matching Markets, & Economic Engineering

Alvin Roth is the Winner of the 2012 Nobel Memorial Prize in Economics.

He is the Craig and Susan McCaw Professor of Economics at Stanford University & the Gund Professor of Economics and Business Administration Emeritus at Harvard University. He was the President of the American Economic Association in 2017.

By Aiden Singh, April 24, 2025

Paul Krugman On Trade, Tariffs, & America’s Role In The Global Economy

Paul Krugman is the Winner of the 2008 Nobel Memorial Prize in Economics & the 1991 John Bates Clark Medal.

He is a Distinguished Professor of Economics at the City University of New York’s (CUNY) Graduate Center & Former Professor of Economics and International Affairs at Princeton University’s Woodrow Wilson School.

By Aiden Singh, April 17, 2025

Is Two-Party Politics Really Dead In The UK?

By Simon Wren-Lewis, April 22, 2025

Simon Wren-Lewis is Emeritus Professor of Economics and Fellow of Merton College, University of Oxford. He Was One of the Seven Members of the UK Labour Party’s 2015-2016 Economic Advisory Committee.

Robert Wilson On Economic Engineering, Game Theory, & Auction Design

Robert Wilson is the Winner of the 2020 Nobel Memorial Prize in Economic Sciences.

He is the Adams Distinguished Professor of Management Emeritus at Stanford University School of Business. Professor Wilson is the Co-Inventor of An Auction Format Which Shaped The Entire Modern U.S. Telecommunications Industry. He is Known As ‘The Dean Of Market Design’.

By Aiden Singh, March 10, 2025

Dividends and Buybacks - Inertia and Me-tooism!

By Aswath Damodaran, March 5, 2025

Aswath Damodaran is Professor of Finance at New York University Stern School of Business.

He Is Known On Wall Street As The ‘Dean Of Valuation’.

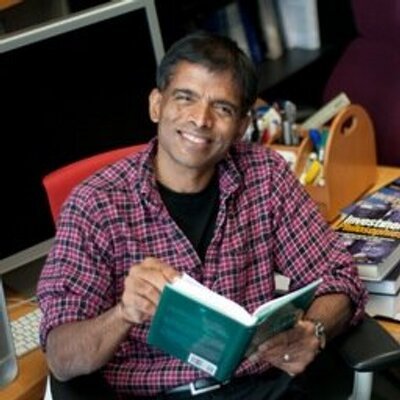

Raghavendra Rau On Insights From Behavioral Finance & Whether It’s Possible To Beat The Market

Raghavendra Rau Is Professor of Finance at the University of Cambridge Judge Business School.

He Can Be Booked For A Speaking Engagement Here.

By Aiden Singh, March 3, 2025

Making DeepSeek Speak About Tiananmen

By Johan Hombert, February 9, 2025

Johan Hombert is Professor of Finance at HEC Paris.

Book A Speaker

Book world-leading experts for keynote speeches, panel events, lectures, and conferences.

Ben McAdams On Running For Mayor Of Salt Lake County

Ben McAdams is a Former Member of the United States House of Representatives (2019-2021).

By Aiden Singh, February 6, 2025

Ian Ball on Reforming New Zealand’s Public Financial Management System, Why Governments Should Adopt Accrual Accounting, & Why They Should Track and Strengthen Public Net Worth

Ian Ball was the principal architect of the New Zealand government’s financial management reforms in the 1980s.

He Can Be Booked For A Speaking Engagement Here.

By Aiden Singh, January 25, 2025

Annamaria Lusardi On Improving Financial Literacy

Annamaria Lusardi is the Director of the Initiative for Financial Decision-Making (IFDM) at Stanford University.

By Aiden Singh, January 22, 2025

SSE Career Portal

Take The Next Step In Your Career At A World Class University, International Organization, Government Agency, Or Private Sector Enterprise

Market An Open Position To The World’s Leading Academics, Policy Advisors, C-Suite Executives, PhD Candidates, And More

Robert Wilson & Aiden Singh Discuss The Encyclopedia

Robert Wilson is the Winner of the 2020 Nobel Memorial Prize in Economic Sciences.

By Aiden Singh, December 13, 2024

Dag Detter On Restructuring The Swedish Government’s Portfolio Of Public Commercial Assets

From 1998 - 2001, As Head Of The National Wealth Fund Dag Detter Led A Restructuring Of The $70 Billion Portfolio Of Swedish Government-Owned Companies.

He Can Be Booked For A Speaking Engagement Here.

By Aiden Singh, November 26, 2024

Steven Pinker On Enlightenment Values, Liberal Democracy, & Human Progress

Steven Pinker is the Johnstone Family Professor of Psychology at Harvard University.

He has been named one of the “World’s Top 100 Public Intellectuals” by Foreign Policy Magazine & one of the “100 Most Influential People in the World Today” by Time Magazine.

By Aiden Singh, October 31, 2024

The Sugar Daddy Effect? Assessing Corporate Venture Capital, Sovereign Funds And Green Energy

By Aswath Damodaran, October 28, 2024

Aswath Damodaran is Professor of Finance at New York University Stern School of Business.

He Is Known On Wall Street As The ‘Dean Of Valuation’.

Gary Klein On Political Polarization, American Institutional Decay, The 2024 Election, & How Studying Art Can Teach Us About History and Politics

Gary Klein is Professor of History at SUNY Westchester Community College, Co-Chair of the New York City Chapter of the Alumni and Friends of the London School of Economics (LSE), & a Member of the State of the Union Working Group.

By Aiden Singh, October 14, 2024

Daniel L. Thornton On The Federal Reserve’s Response To The Collapse Of Lehman Brothers

In Memoriam Daniel L. Thornton

Daniel L. Thornton was a research economist at the Federal Reserve Bank of St. Louis for 33 years and President of DL Thornton Economics.

Jochen Runde On Uncertainty, Probability, And Heuristics

Jochen Runde is Professor of Economics and Organization at the University of Cambridge.

By Aiden Singh, February 17, 2024

Saule Omarova On The Weaknesses Of The Current Banking System & Her Proposal For A ‘People’s Ledger’

Saule Omarova is Beth and Marc Goldberg Professor of Law at Cornell University School of Law. She is a Member of the State of the Union Working Group.

By Aiden Singh, November 2, 2023

Roger Backhouse On Robbins, Keynes, Samuelson, & The Relationship Between Economics And The Other Social Sciences

Roger Backhouse is Emeritus Professor of Economics at the University of Birmingham.

By Aiden Singh, September 8, 2023

Kevin Featherstone On The State Of The West & The Upcoming Greek Election

Professor Kevin Featherstone is Director of the London School of Economics (LSE) European Institute’s Hellenic Observatory. From 2009-2010, he was a Member of The Advisory Committee to Greek Prime Minister Georgios Papandreou for the Modernization of the Operation of the Government.

By Aiden Singh, May 16, 2023

Robert Guttmann On The Collapse of Credit Suisse, AT1 Bonds, And The Dilemma Central Banks Are Facing

Robert Guttmann is Professor of Economics at Hofstra University & former Associate Professor at the Centre d’Économie Paris-Nord (CEPN), Université Paris XIII. He is a Member of the State of the Union Working Group.

By Aiden Singh, March 30, 2023

Willem Buiter On The Ongoing Banking Panic

Willem Buiter is a former member of the Monetary Policy Committee of the Bank of England, former Global Chief Economist at Citigroup, and former Professor at the London School of Economics, Yale University, & Cambridge. He is a Member of the State of the Union Working Group.

He can be booked for a speaking engagement here.

By Aiden Singh, March 18, 2023

Koichi Hamada On ‘Abenomics,’ The Asia-Pacific Security Situation, And Inflation

Koichi Hamada Is A Former Economic Advisor To Former Japanese Prime Minister Shinzo Abe And Tuntex Professor Emeritus of Economics at Yale University.

By Aiden Singh, February 24, 2023